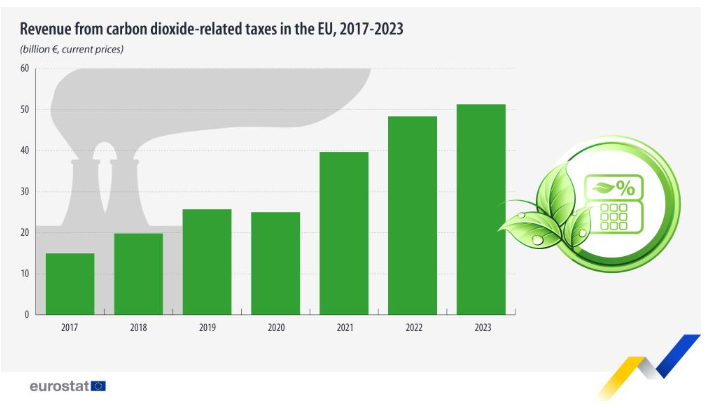

Between 2017 and 2023, the revenue from carbon dioxide related taxes in the EU increased strongly, growing from €15 billion to €51 billion. Carbon (dioxide) taxes are levied on the carbon content of fossil fuels. Their share in the overall energy taxes increased from 6.0% in 2017 to 19.7% in 2023.

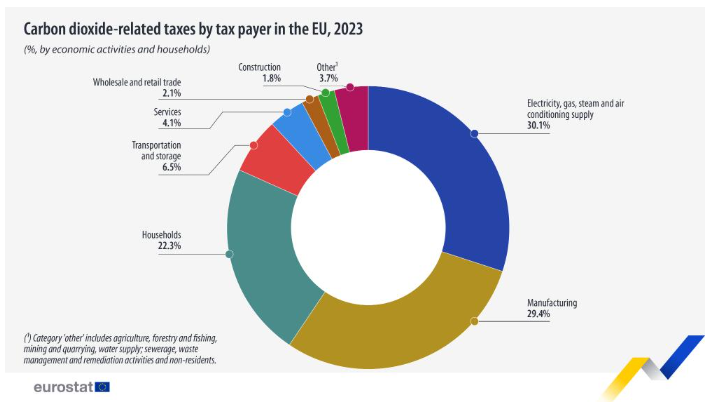

In 2023, more than three-quarters (76.4%) of the carbon taxes were collected from businesses, while households contributed 22.3% and non-residents 1.3%. The energy sector (supply of electricity, gas, steam and air conditioning) contributed 30.1% of total carbon taxes, followed closely by manufacturing, which accounted for 29.4%.

O artigo foi publicado originalmente em Eurostat.